Asset Preservation Strategies

We provide strategies for our clients to better help them enjoy retirement with comfort and confidence. We welcome the opportunity to put our insight and experience to work for you.

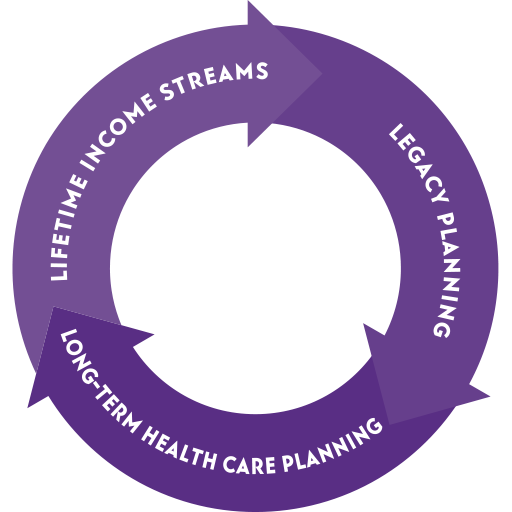

STRATEGIES FOR FINANCIAL CONFIDENCE

We provide strategies for our clients to better help them enjoy retirement with the comfort and confidence of finalizing their income, legacy, and health care plans. We welcome the opportunity to put our insight and experience to work for you.

Lifetime Income Streams

Lifetime Income Streams

Legacy Planning

Legacy Planning

Long-Term Health Care Planning

Long-Term Health Care Planning

We offer services in these three areas:

Lifetime Income Streams

Prepare for retirement by putting your hard-earned assets to work with guarantees.

How?

Indexed Universal Life (IUL)

Fixed Indexed Annuities

Fixed/ Immediate Annuities

IRA’s/ Roth IRA’s

Legacy Planning

Protect your legacy by amplifying your giving amount through the wonders of life insurance. When properly planned, your legacy skips your estate and is given tax-free to your beneficiaries.

How?

Indexed Universal Life Insurance (IUL)

Guaranteed Universal Life

Term Life Insurance

Long-Term Health Care Planning

We help you protect your legacy by preparing you for the long road to come. Rather than let health expenses throw off your retirement, let’s plan ahead.